The game just changed yet again and the purpose of this report is to let you know exactly where you stand as a home seller in the present market.

In this quick report, I’m presenting you with four rock-solid reasons that now’s a great time for Owen Sound home owners to consider listing.

Nevermind the Bank of Canada’s latest rate hike – the prices of homes are just going to keep on rising no matter what and I’m going to show you how.

Let’s tackle the first question:

1 – Why won’t this latest hike affect your desired sales price?

No one can simply answer this with 100% accuracy, but if we take a look at how all the previous hikes have affected the local market, we’ll get an accurate picture.

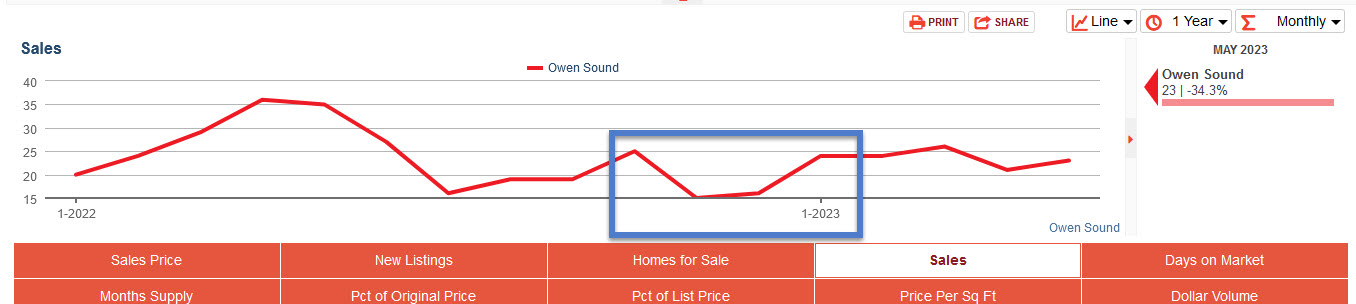

In July of 2022, the BOC hiked its rate by one full point and the market did react in kind.

The July hike caused the average Owen Sound home price to drop by over $40K.

The mid-summer hike also killed all momentum the market had and tanked sales.

Then, just as things were starting to pick up again in the fall, the BOC had two more hikes in both September and October.

Once again, the average sales price did go down, but the hikes also killed all sales momentum.

Yet, no matter what the BOC does, the market invariably recovers from it and the rise picks back up again.

2 – Prices will continue to go up regardless of the hikes

I don’t believe the folks at the Bank Of Canada are deliberately trying to hurt us, but they are working against their own endeavors.

One of the reasons the market keeps picking back up lends itself to immigration, which helped Canada’s population grow by a million people last year.

The Trudeau government will be letting close to 500,000 immigrants into the country each year going into 2026.

A lot of the sales that’ll be coming over the next few years will be coming from new Canadians.

And that brings us directly into reason #3 why rate hikes aren’t likely to affect the sale of your home.

3 – Construction shortage

In April of 2022, the Liberal government unveiled plans to double housing construction over the next ten years.

Unfortunately, we’re presently facing a residential construction squeeze.

Residential construction in Canada is 20% lower in 2023 than it was in 2022.

This can be blamed on a tight labor market, the constantly increasing cost of materials and higher borrowing rates.

We now have the perfect storm – more people are immigrating to Canada at a time when housing starts are crashing.

4- Attack of the NIMBYS

If you’re not familiar with the NIMBY acronym, it stands for “not in my backyard”.

When the Ford government passed Bill 23, which loosened many restrictions for development in an attempt to stimulate more construction, it was met with a lot of controversy.

All the critics of the bill could focus on was how the Ford government was going to use less than 1 percent of the greenbelt to create more housing.

So rural NIMBYs are opposing any and all development on the greenbelt arguing there’s plenty of urban space that can be redeveloped.

They’re not entirely wrong – there really is a lot of urban land that could be put to better use.

Problem is, what they’re proposing is far more easily said than done.

Urban NIMBYs are fighting back against those plans to intensify their neighborhoods in the city, citing everything from infrastructure concerns to uglification as reasons.

So not only do we have the conflict of increased immigration versus lower rates of construction, we have special interest groups blocking off large swaths of land that can be built upon.

5 – The hidden money

While the increasing interest rates and the much-hated stress test does have an impact on the real estate market, it cannot stem the flow of money.

Don’t forget that we’re in the age now where a lot of Baby Boomers are leaving large inheritances behind and that is something that will arm buyers no matter what the market is saying.

Also, the longer potential home buyers are left out of the market, the more time they have to keep saving money.

Bottom Line:

If you look at Owen Sound’s trajectory, even if COVID had never happened, prices were going to go up.

Sure, if the pandemic never happened, the increase in price would not have been so sharp, but the shortage in inventory works in the sellers’ favor.

Yes, the latest rate hike will have some effect, but with construction of new homes hitting a wall and more immigrants settling in Canada, it’s going to be a seller’s market for a while yet, even if it’s a slower moving one.

_______________________

If you want a clear, No-BS assessment of how much your home is worth AND how long it would take for you to sell it, I’m here to help.

Just fill out the form below to get started or go here: